How Digital Payments Are Changing the Way People Shop in Finland

Imagine entering your preferred Helsinki coffee shop, tapping your phone or card, and leaving without ever touching cash. Greetings from Finland, where digital payments have replaced cash as the dominant form of payment. In my master's thesis at Novia UAS, I explored this change from a human perspective rather than a technological one, showing how these advancements are genuinely altering our behavior, thoughts, and expectations as customers. Convenience is not the only factor here, it has to do with habits, trust, feel, and psychology act of payment. The ideal testing field was Helsinki, Espoo, and Vantaa, which are residence to Finland's most technologically advanced residents.

The transition from payment in cash to contactless

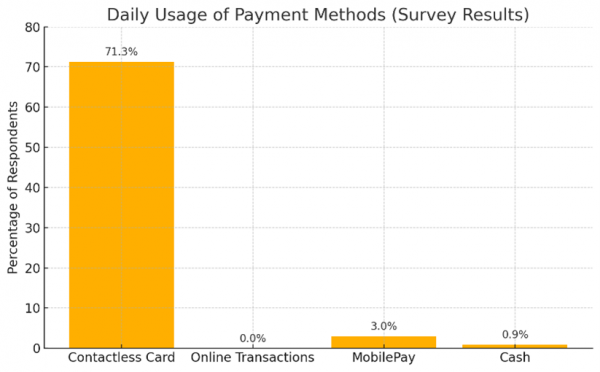

Do you recall the days when individuals carried wallets full of cash? Those days are quickly passing in Finland. The percentage of respondents who still prefer utilizing cash is less than 1%. Rather, contactless card payments are already commonplace. More than 71% of those surveyed said they often use contactless cards. That is a change in culture, not a trend.

Convenience is not the only reason for this shift. It shows a greater level of confidence in the nation's financial institutions and digital infrastructure. According to 62% of participants in my study, making digital payments makes them feel secure and private. One of the main causes of digital payments becoming commonplace is this high degree of trust.

MobilePay: Popular, but still not (yet) a daily habit

Even though MobilePay is well-known in Finland, statistics presents a broader picture. The results showed that MobilePay was the underdog in payment option. Everyone is aware of MobilePay, and they use the app. However, they aren't using it as frequently as one might think. Just 3% of the respondents use MobilePay every day, despite 56% using it at least once a month. In contrast to contactless cards, which are used every day, MobilePay acts as more of a "sometimes" choice.

Why? Many believe that they mostly utilize it for small, personal transactions like sharing bills or buying lunch for a friend. Because contactless cards are already so convenient, some people continue to use them. The catch is that simplicity prevails in Finland. Why do people open an app if they can tap a card?

MobilePay still has a lot of promise, though. There is infrastructure. There is trust. There is a user base. It only has to be used more frequently now, maybe with some encouragement from management or reward plans.

Figure 1. Payment Methods Dominate Daily Use

Online payments: Weekly requirement

For Finnish customers, online shopping has become commonplace. Indeed, according to 65% of those surveyed, they pay online at least once per week. Digital payments are ingrained in daily life, whether they are used for rent payments, streaming services, or clothing purchases.

With the growth of e-commerce, this tendency is only getting faster. Digital transactions are becoming more frequent and more comfortable as more services are moved online. It's obvious that customers want quick, easy, and safe payment methods, and companies need to adapt.

Security and trust: The silent forces

Trust is crucial in today's digital environment, particularly when money is at stake. It is encouraging to note that 62.4% of participants in my survey from Helsinki, Espoo, and Vantaa stated that they believe digital payments to be private and safe. That is a resounding endorsement of Finland's sophisticated internet infrastructure and tech-savvy populace.

However, the tale doesn't stop there. Upon deeper inspection, 6.9% of consumers still strongly disagree about recommending digital payments to others. Although it's not a large amount, it's sufficient to analyze customer behavior. It may have occurred because of most people's privacy concerns or because some individuals were just uneasy utilizing digital technologies. This suggests a more serious problem: even in technologically advanced cultures like Finland, there are differences in digital literacy.

The message is simple: building safe systems is not enough; people need to educate usability and foster trust. For those who were not raised in the digital era, financial institutions, companies, and legislators must ensure that digital payment platforms are not just safe but also feel safe. In summary, people's attitudes toward utilizing payments will determine its acceptance in the future, not simply the technology.

The elderly are getting up to speed

Contrary to popular belief, digital payments are not primarily used by younger people. More than 55% of those aged 55 to 65 said they used contactless card payments daily. That serves as a powerful signal that digital practices are not limited to digital advanced people but are expanding throughout Finland's age range.

Once the obstacles of familiarity and trust are addressed, this gives businesses new chances to customize digital experiences for elderly customers, who are equally keen to benefit from speed and convenience.

It's psychology, not just technology

The way that social and emotional elements affect payment behavior is among the most surprising conclusions I drew from my research. The availability of digital payment isn't the only factor influencing people's decisions; convenience, trust, and even societal conventions play a role.

As an example:

- 86% of consumers like companies that accept digital payments.

- Even if cash were still accessible, 85% of respondents would still use digital payments.

- According to 79% of respondents, using digital payments enhances their entire shopping experience.

These figures imply that consumers are increasingly identifying with digital payments. It's not just about what individuals do; it's also about how they see themselves: as innovative, efficient, and technologically savvy.

Behind the research

During this journey, I was surprised by the closeness this subject got. I became aware that payment is about much more than just money after responding from consumers, examining their behaviors, and even thinking about myself. It comes down to confidence. Identity. Trust and comfort.

My MBA thesis from Novia University of Applied Sciences, "Impact of Digital Payment Systems on Consumer Behavior," served as the basis for this blog. I used behavioral and technological adoption models like TAM and UTAUT to examine the results from a survey I conducted with 101 adult consumers in the Helsinki metropolitan region.

Dr. Outi Ihanainen-Rokio supervised the research and provided significant advice and ideas.

About the author

Md. Ruhul Amin is a sales and marketing specialist with a solid foundation in digital transformation, consumer behavior, and strategic planning. In Novia University of Applied Sciences in Vaasa, Finland, he is presently finishing his Master of Business Administration in Digital Business and Management. His thesis examines the effects of digital payment systems on customer behavior in metropolitan Finland.

Ruhul previously graduated from BRAC University with a BBA in Marketing and Finance and an MBA in Marketing. In his career, he has held important positions including Chief Strategy Officer at That Quick Dot Com Ltd. and Assistant Manager at ACI Logistics Ltd., where he oversaw cross-functional teams, created business plans, and spurred expansion using creative digital solutions. Ruhul adds a practical perspective to his academic work with his practical expertise in CRM leadership, sales forecasting, and category management. He is interested in the relationship between consumer psychology and digital technology, and his research attempts to connect theoretical understanding with practical market applications.

In this blog you'll read posts from students studying for Master of Business Administration, Digital Business and Management, MBA. The writers are responsible for the content and opinions in the blog text.

Digital Business and Management, MBA

Disclaimer: The author(s) are responsible for the facts, any possible omissions, and the accuracy of the content in the blog.The texts have undergone a review, however, the opinions expressed are those of the author and do not necessarily reflect the views of Novia University of Applied Sciences.

Posta din kommentar

Kommentarer

Inga har kommenterat på denna sida ännu